In this article:

When I first started using PocketSmith there was no such thing as rollover budgets. This was a problem in two main areas:

If you had an annual budget, there was no way to spread this out across budget periods.

If you had a regular budget that you'd be happy to overspend in one period and catch up in the next, or save a little in one period to be able to spend more in the next, there was no way to handle this.

Let's have a look at both scenarios:

Annual budgets

Adhoc, variable spending that you just can't account for in shorter periods. Examples include automotive maintenance expenses, gifts, holidays.

The issue with annual budgets without rollovers is most stark on the Cashflow Statement. If your annual budget started in April, for example, the budget amount for the whole year would show in April. This would make the total budget in April look massive and lower the budget amounts for each month for the rest of the year.

Rollovers in PocketSmith have changed everything.

Now you can take that annual budget and smooth it across the year. Sometimes you'll be up, sometimes you'll be down, but overall you'll be able to able to keep track of the budget across the year. A great example of this is gifts. Birthdays and other events pop up at random times throughout the year. My wife and I set a total budget for gifts for the year. Rollovers allow us to spread that budget expenditure across the year. Yes it is very difficult to decrease the gift budget, you still have to be equitable, but we do what we can 😀.

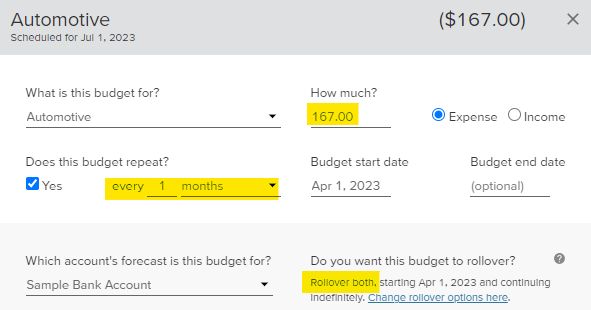

Here is that same automotive expense budget with rollovers enabled:

Regular budgets

A regular budget, such as groceries or gasoline/fuel, that you're happy to overspend in one period and save in the next or underspend in one period and spend more the next.

Before PocketSmith rollover budgets the budget amount reset to zero at the start of the next period. PocketSmith simply viewed an underspent budget as savings. This is most stark on the Trends report.

Rollovers in PocketSmith have changed everything.

Now you can effect future budget periods by what you spend or save in this period.

Here are a few ways you might find this useful:

You can have a budget that is a little inconsistent - goes up and down each period, but overall you try and make it equal what you budgeted over time.

Similarly, if you perform an annual budget review, your budget can get a little out of control, then you spend the rest of the year trying to get it back to zero by saving a little each period (that seems to be what we often do at least 😀).

You can save a little extra in budget each period, knowing that a bigger period of spending is coming.

You can put a few dollars in a budget for little Johnny to save for something he wants but can't afford today.

You can use a digital version of the most effective budgeting method ever invented - the envelope system. The cash envelope system involves placing cash into an envelope for each budget, each period (e.g. every fortnight or depending on when you get paid). The cash in the envelope is all you have to spend for that budget, there is no more. If you want to save for something, you have to let cash accumulate in that envelope. The envelope system promotes discipline and is the purest form of budgeting. I will cover how to use the envelope system in PocketSmith, in a forthcoming blog post.

Here is the same groceries budget with rollovers enabled: (We will look at how to read this report below.)

How to set up rollover budgets

As of July 2023, PocketSmith rollover budgets are a beta feature, along with Safe Balance, colour display, and improved payee cleaning.

PocketSmith says,

"Rollover has been a beta feature for quite some time now, and we would love to get it out of beta and fully release it. However, we have yet to be able to provide a timeframe on when that will be.

Rollover budgeting is one of the more complex features of PocketSmith, and we want to be fully confident that when we release it to all users in that we've worked out any kinks and bugs that can happen with beta features."

(That being said, I have never experienced a single bug with the rollovers feature.)

You can join the beta programme from the user preferences menu.

Once joined, new options appear in the category and the budget forms. When adding rollover to a budget the first time, you select your rollover method from the budget form. The options are:

No rollover - each budget period starts from zero

Both underspent and overspent amounts - you spend too much, you have less to spend next period. You spend less than budget and you have more to spend next period.

Only underspent amounts - you spend less than budget and you get that money in the next period. If you spend too much, it has no impact on the next periods.

Only overspent amounts - you spend too much and it's taken off the next budget period. If you spend less than budget, you don't get that in the next period.

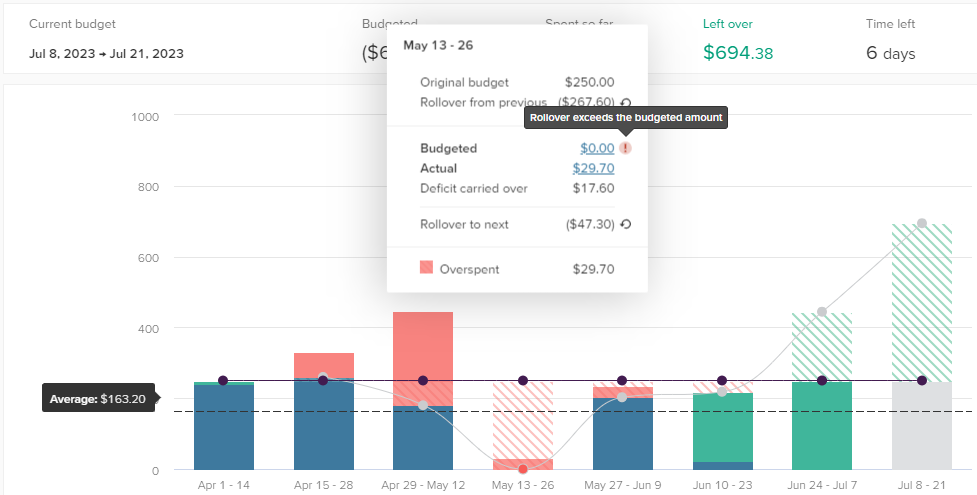

What happens if you overspend a budget by more than this and the next budget amounts combined?

Even if you go way way into deficit, PocketSmith will carry that over to future periods. Check out How to read the Trends report for rollover budgets below for more.

Edit or delete budget rollovers

You will likely never do this. When changing rollover option on a budget with rollovers already applied, things get a little complicated. It's clear that PocketSmith has to be very smart about handling rollovers - especially remembering what rollover settings you previously had, if at some point you change them. When editing rollovers on a budget you will be taken to the category page. You can change the rollover method and PocketSmith will save the previous rollover you had and add a new rollover period to the category.

Delete all rollover periods

You might give rollovers a try but decide they're not for you. If that's the case the current way to delete a rollover period is to select "Adjust rollover periods" from the Category form and make the end date of the rollover period earlier than the start date. It seems odd, but Rollovers are super complex so we'll give PocketSmith a pass on this one because the solution works fine.

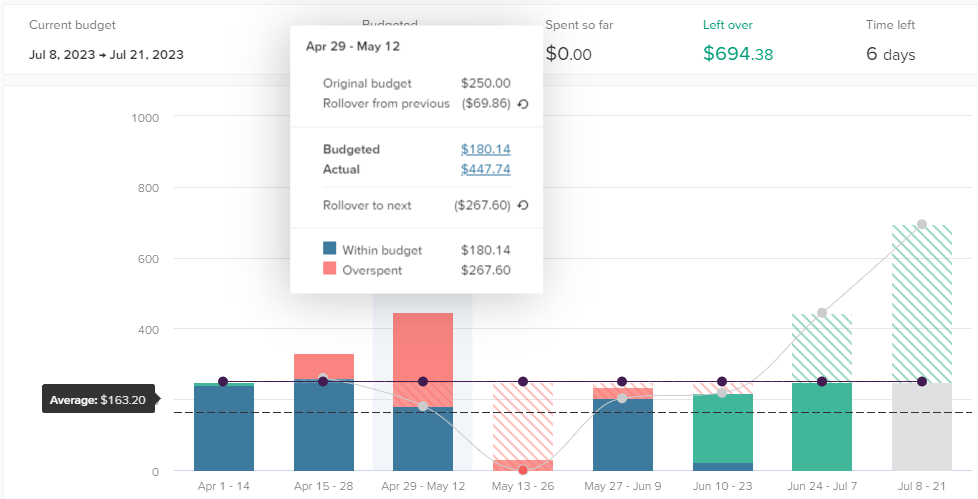

How to read the Trends report for rollover budgets

The absolute best place to understand what's happening with your rollover budgets is the Trends report. With rollovers turned on, this report can be quite busy. It shows your regular budget amount, the rollover amount + regular budget amount, how much you have spent within budget, how much surplus you used from a prior period, how much you overspent the budget period, how much you saved or underspent the funds you have available in that period, how much surplus you have accumulated through underspending, and how much your budget has decreased through overspending. It's a lot!

Here is a particularly complicated Trend report showing periods of underspending, overspending, significant overspending, a period in deficit, and significant underspending.

How to reset a rollover budget to zero

You might want to continue using an existing budget but reset the rollover to zero. Perhaps, like me, you perform a budget review every year and like to start your budgets from zero at the start of the year.

From the Trends report, hover over the period column you'd like to reset and select the reset icon.

How to redistribute rollover surplus

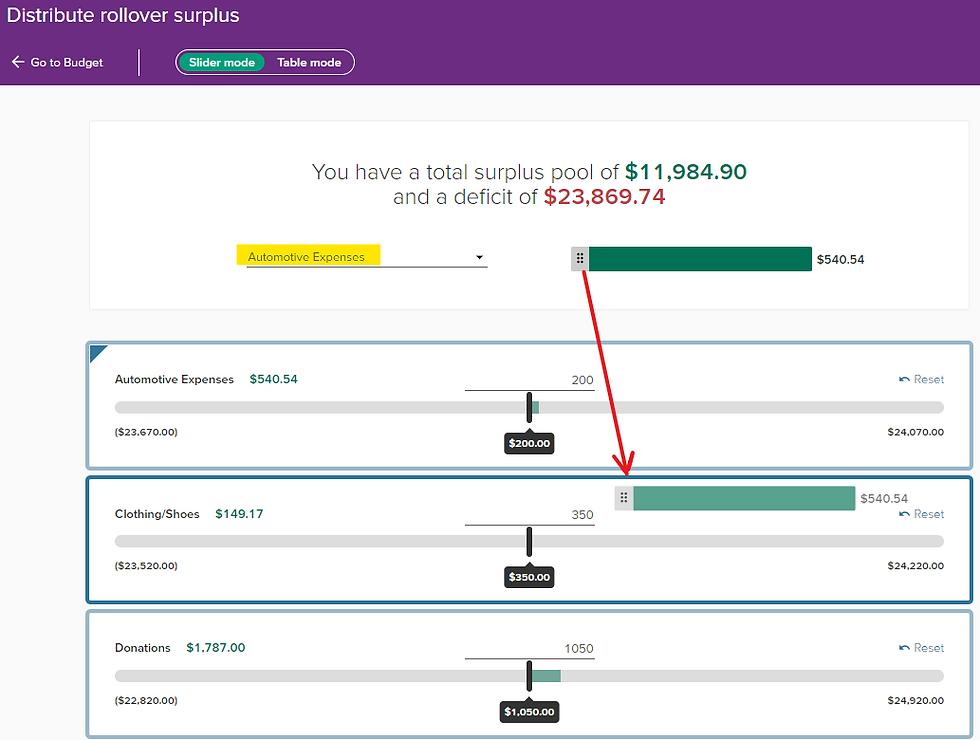

From time to time you might want to move a surplus you have achieved in one budget, into another budget. Maybe the weather has been bad so you have been eating at home rather than going out and you'd like to shift the surplus from your restaurants budget into your grocery budget. From the budget page select "Distribute rollover surplus".

There are two available modes for redistributing rollover surplus:

Slider mode - a graphical interface that also allows drag and drop

Table mode - a data-only interface

In either mode you can redistribute the whole budget surplus or part amounts of a surplus to one or more budgets.

Have I helped?

I hope you have found this article useful.

Websites cost money to run and I put a lot of thought and time into Pocket Kiwi content so please consider using my link when signing up to a paid PocketSmith account, or buy me a coffee. Every little bit helps.